tax forgiveness pa chart

Common IRS Questions and Errors. If youre approved for tax forgiveness under Pennsylvania 40 Schedule SP you may be eligible for an income-based Earnings Tax refund.

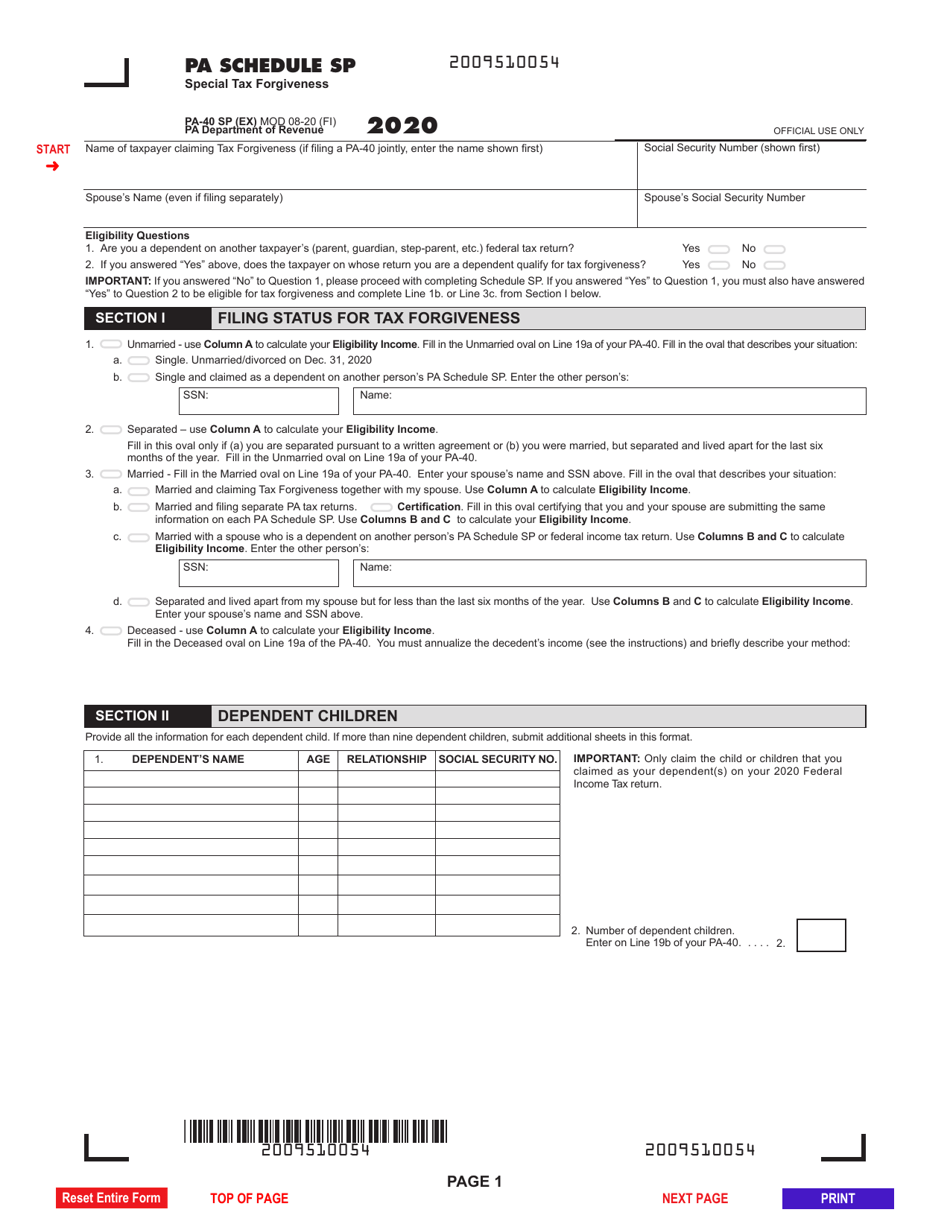

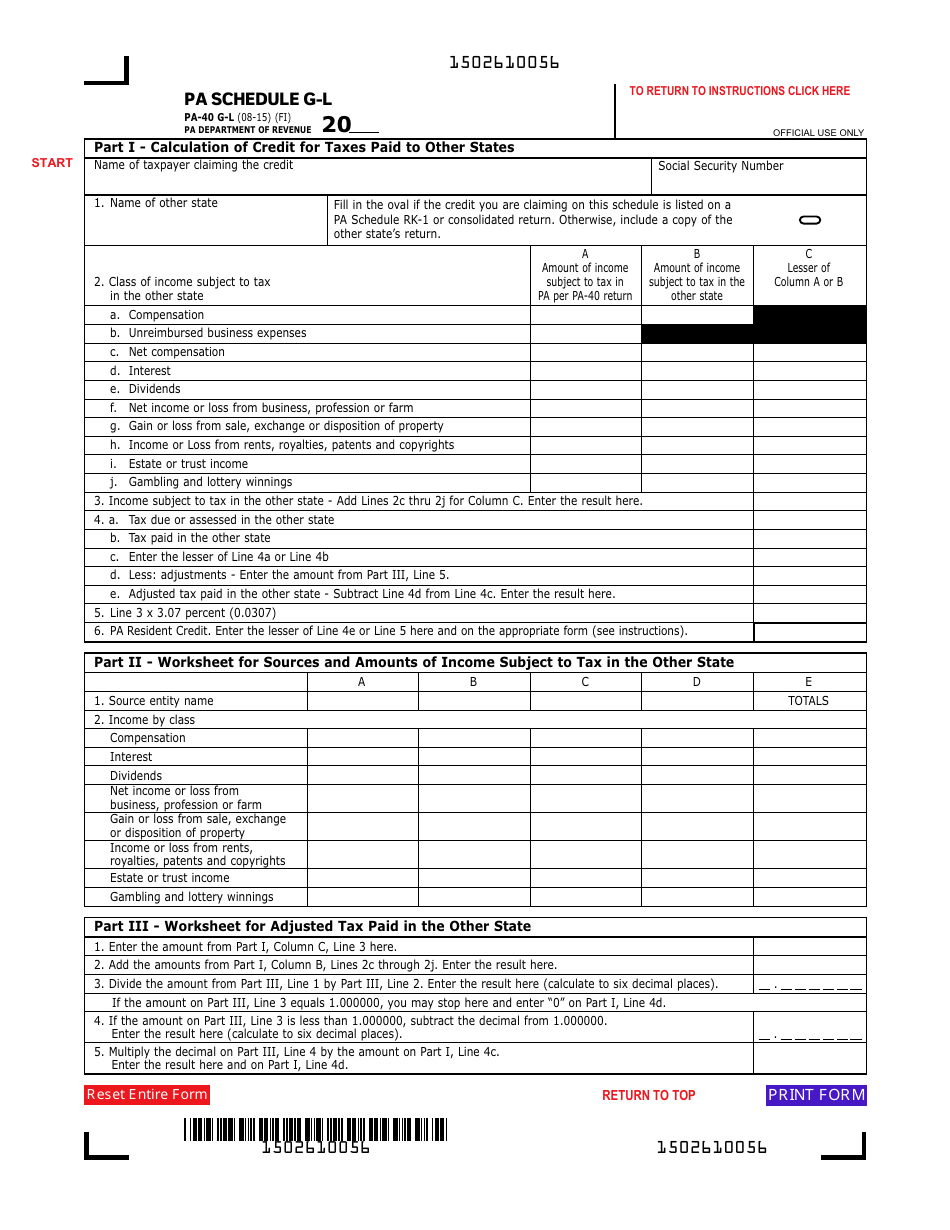

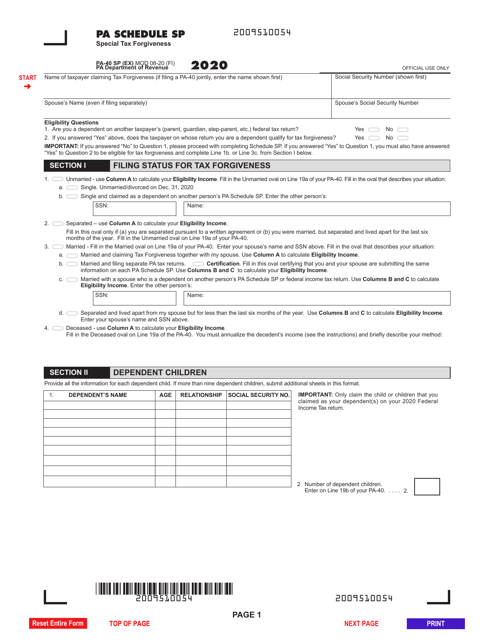

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

If you are filing as Married.

. EASTON PA ACCESSWIRE March 18 2022 Paragon Technologies Inc. Formal notice of pwd proposed changes in water wastewater and stormwater rates and charges. IRS Tax Refund Calendar.

Or 3 when forgiveness of the PPP loan is granted. They benefit from higher annual contribution limits than Educational Savings Accounts Coverdell ESAs can be front-loaded for up to five years and sometimes offer a break on state taxesWhile not as flexible they are superior to a. What is Ohm Scale Chart.

Bidens tax plan is estimated to raise about 333 trillion over the next decade on a conventional basis and 278 trillion after accounting for the reduction in the size of the US. Income-based Earnings Tax refund. The private loan debt relief will primarily go to borrowers who took out private subprime student loans made to borrowers with low credit scores through Navients predecessor Sallie Mae between 2002 and 2014 and then had more than seven consecutive months of delinquent payments prior to June 30 2021.

At the bottom of that column is the percentage of Tax Forgiveness for which you qualify. The most frustrating part about this example is the fact that this borrower could have had all their loans eligible for public service forgiveness had they consolidated from day one. The Full List Of Student Loan Forgiveness Programs By State.

Public Service Loan Forgiveness PSLF. The Tax Update is a bi-monthly e-newsletter published by the Pennsylvania Department of Revenue. Finance is the study of money and assetsIt is intertwined but not the same with economics the study of production distribution and consumption of money assets goods and servicesFinance activities take place in financial systems at various scopes thus the field can be roughly divided into personal corporate and public finance.

While taxpayers in the bottom four quintiles would see an increase in after-tax incomes in 2021 primarily due to the temporary CTC expansion by 2030 the plan would lead to lower. 2021-48 permits trusts and estates to treat tax-exempt income resulting from the forgiveness of a PPP loan as received or accrued. The Jerusalem Post Customer Service Center can be contacted with any questions or requests.

PA Schedule SP Eligibility Income Tables. Best Online Stock Brokers. ELIGIBILITY INCOME TABLE 1.

2421 Extension 4 Jerusalem Post or 03-7619056 Fax. The Best Traditional And Roth IRA Accounts. Any questions may be directed to the State Ethics Commission at 717 783-1610 or Toll Free at 1-800-932-0936.

Also review the filing chart Page 4 for proper filing location. The Issue with FFEL Loans and Public Service Student Loan Forgiveness. Amendment to section 407 of the real estate tax regulations to clarify the requirements of the longtime owner-occupant program especially for taxpayers with equitable title.

As a result of this sequence many borrowers lost years towards Public Service Loan Forgiveness. PA Tax Talk is the Department of Revenues blog which informs taxpayers and tax professionals of the latest news and developments from the department. This Form is required to be filed pursuant to the provisions of the Public Official and Employee Ethics Act Ethics Act 65 Pa CS.

People who meet the criteria can receive a refund of up to 05 on City Wage Taxes that their employer withheld from their. Unmarried and Deceased Taxpayers If your Eligibility Income from PA Schedule SP Line 11 does not exceed. No discounts are available for the Earnings Tax.

OTC PINKPGNT a holding company announced its results for the three months ended March 31 2022 on May 13 2022Paragon. 2 when the trust or estate applies for forgiveness of the PPP loan. 529 plans are the most commonly used college savings vehicle among my regular readers.

Who is eligible for private loan debt cancellation. Are you eligible for a discount. If you are filing as Unmarried use Table 1.

17th fl philadelphia pa 19102 or waterrateboardphilagov. 1 as and to the extent that eligible expenses are paid or incurred. In a financial system assets are bought sold and.

Commonwealth Of Pennsylvania V Navient Corporation Et Al Commonwealth Corporate Student Loans

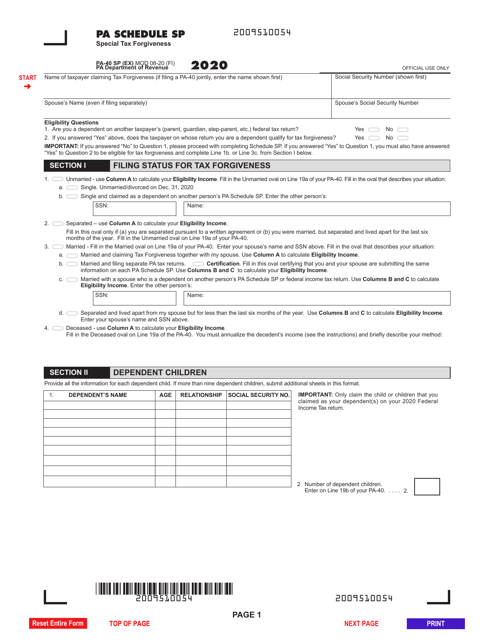

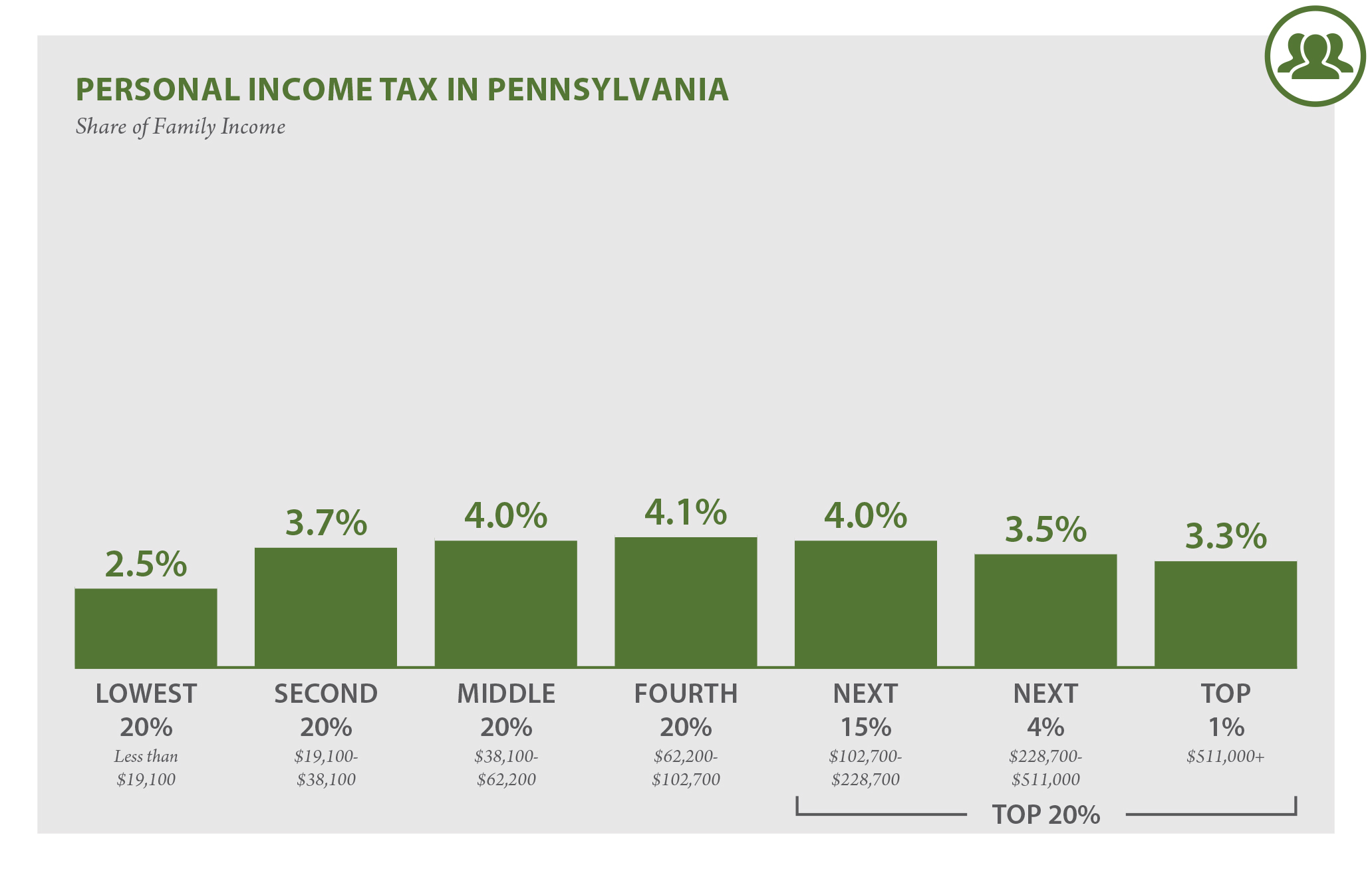

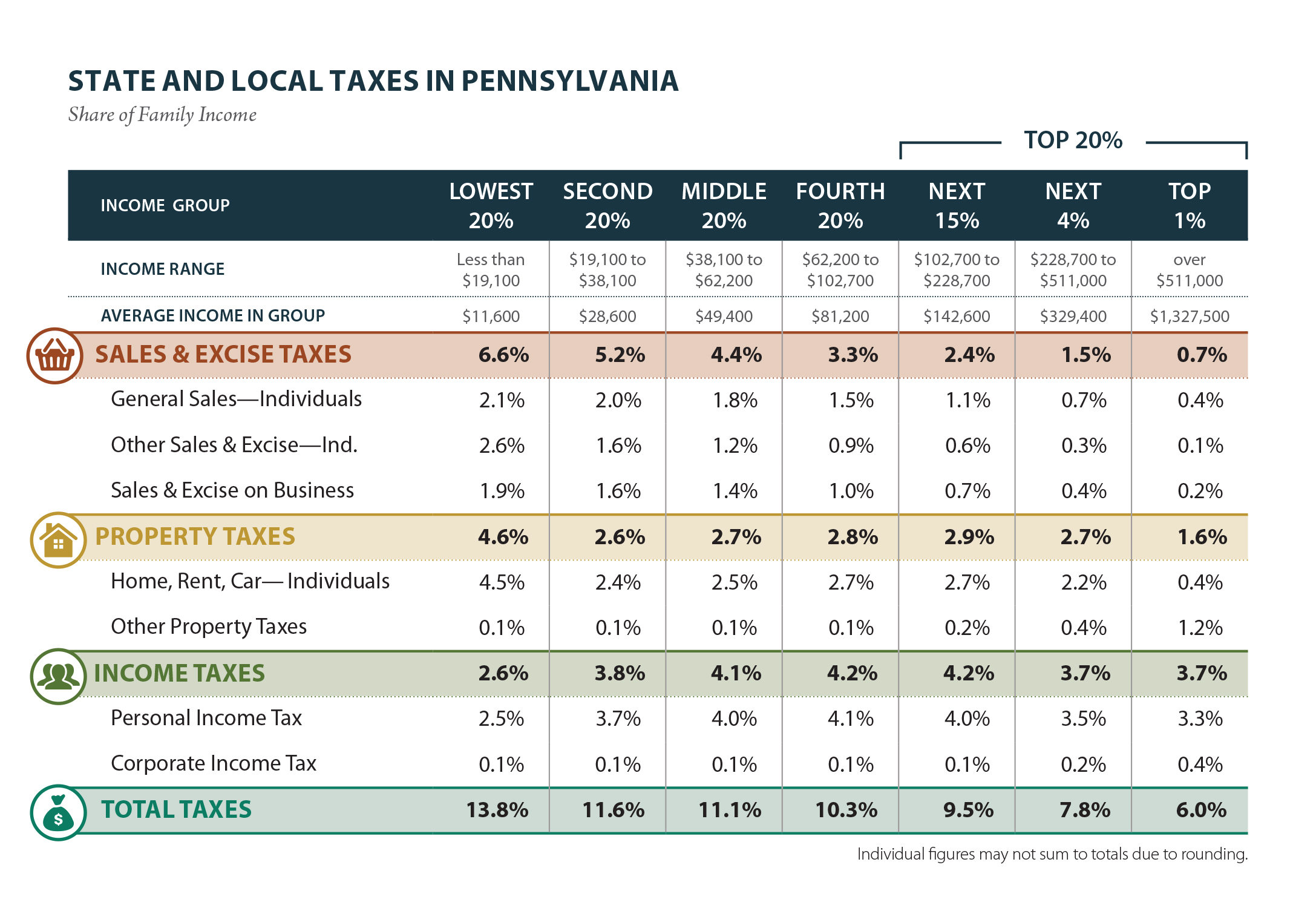

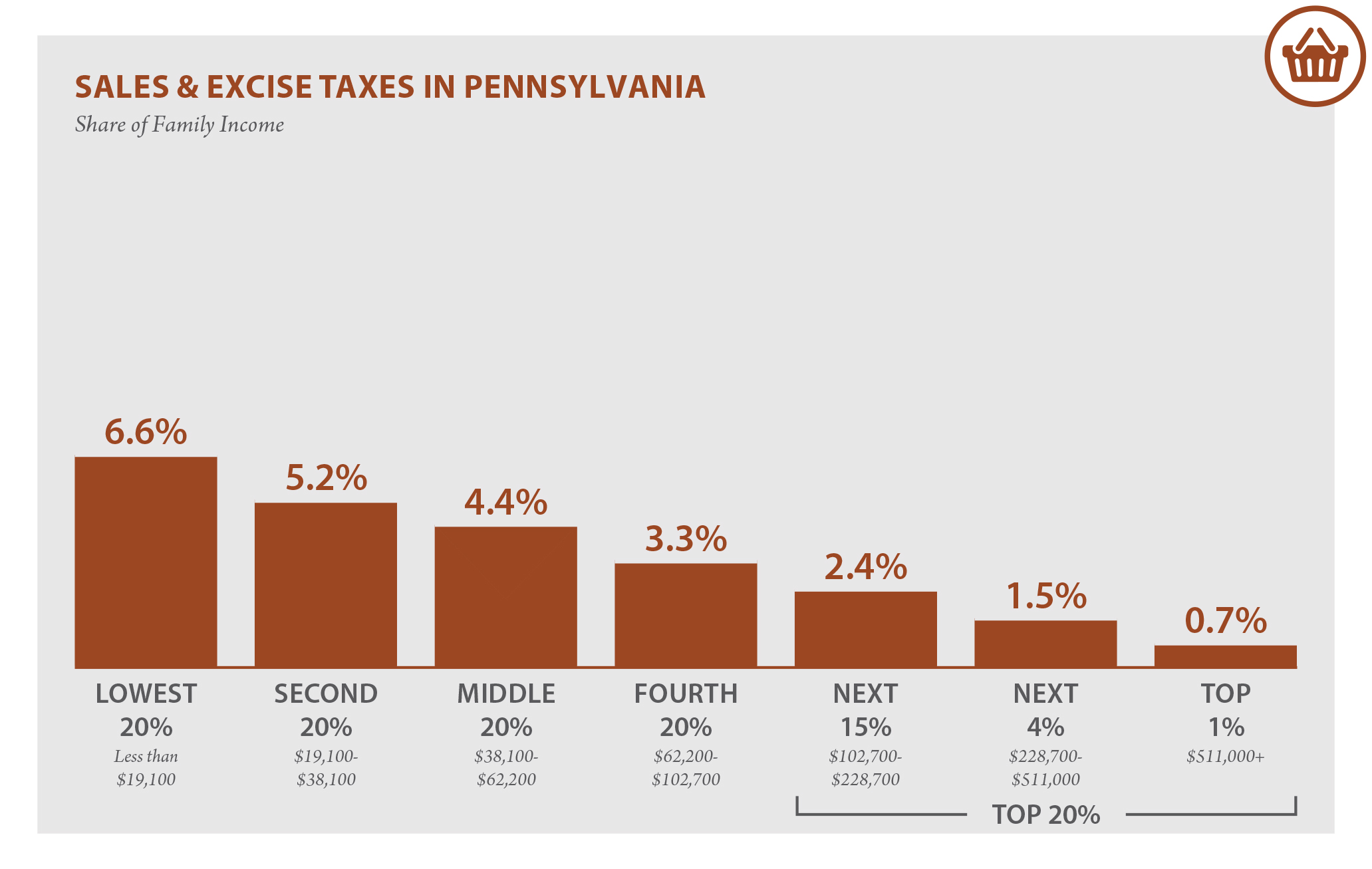

Pennsylvania Who Pays 6th Edition Itep

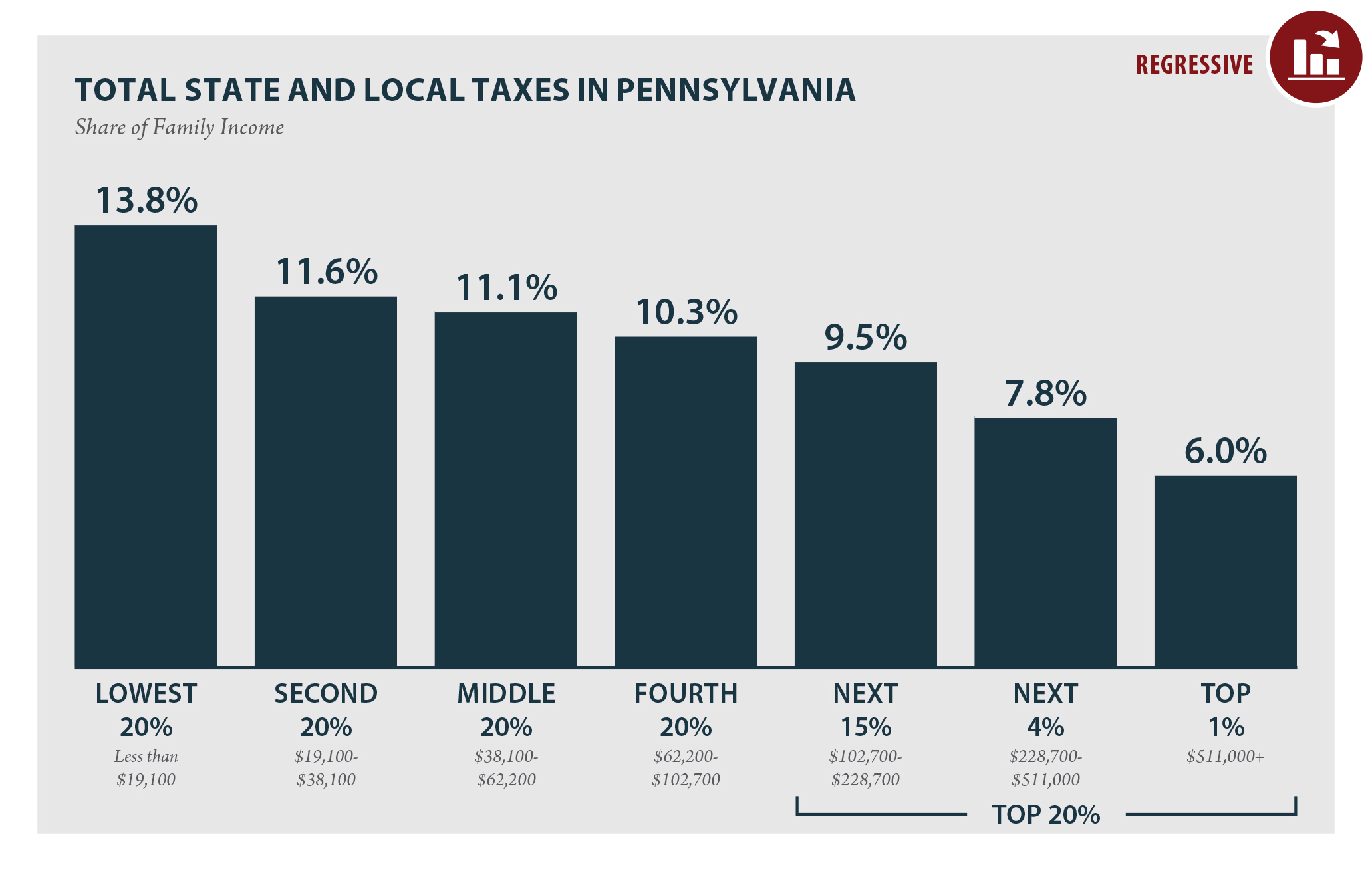

Form Pa 40 Schedule G L Download Fillable Pdf Or Fill Online Resident Credit For Taxes Paid Pennsylvania Templateroller

Pennsylvania Sales Tax Small Business Guide Truic

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Pennsylvania Who Pays 6th Edition Itep

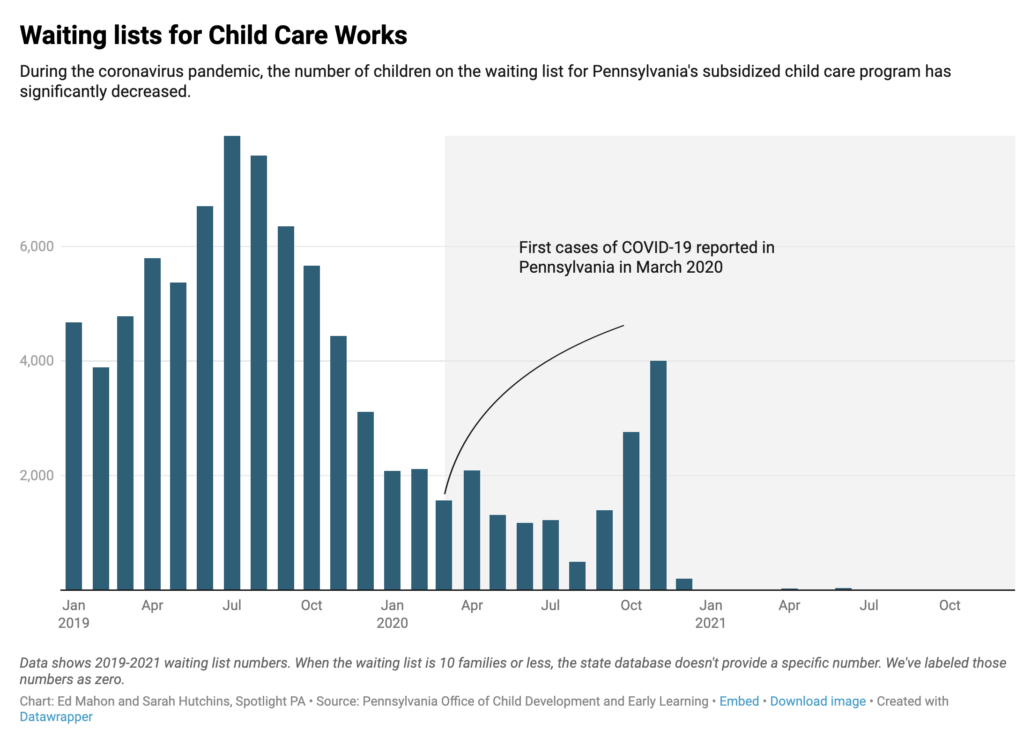

Pa Child Care Enrollment Decline Could Forecast Weak Economic Recovery Whyy

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Pennsylvania Who Pays 6th Edition Itep

Pa Cares Providing Relief For Working People In A Time Of Crisis

Pa Cares Providing Relief For Working People In A Time Of Crisis

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Pennsylvania Who Pays 6th Edition Itep

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

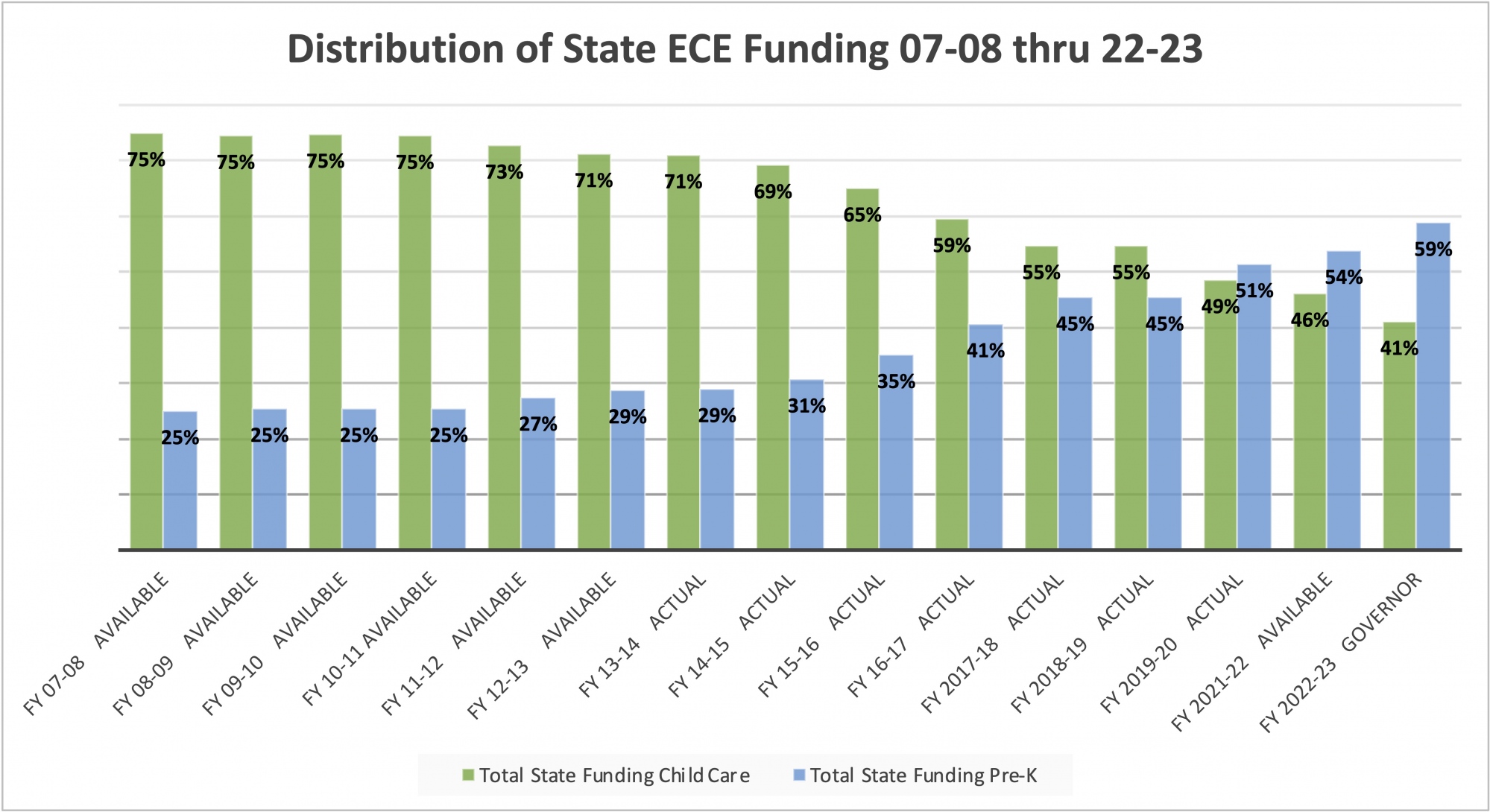

State Policy Budget Issues Pennsylvania Child Care Association